Tax Preparation

… Death and taxes!

I can help you with your personal or business returns.

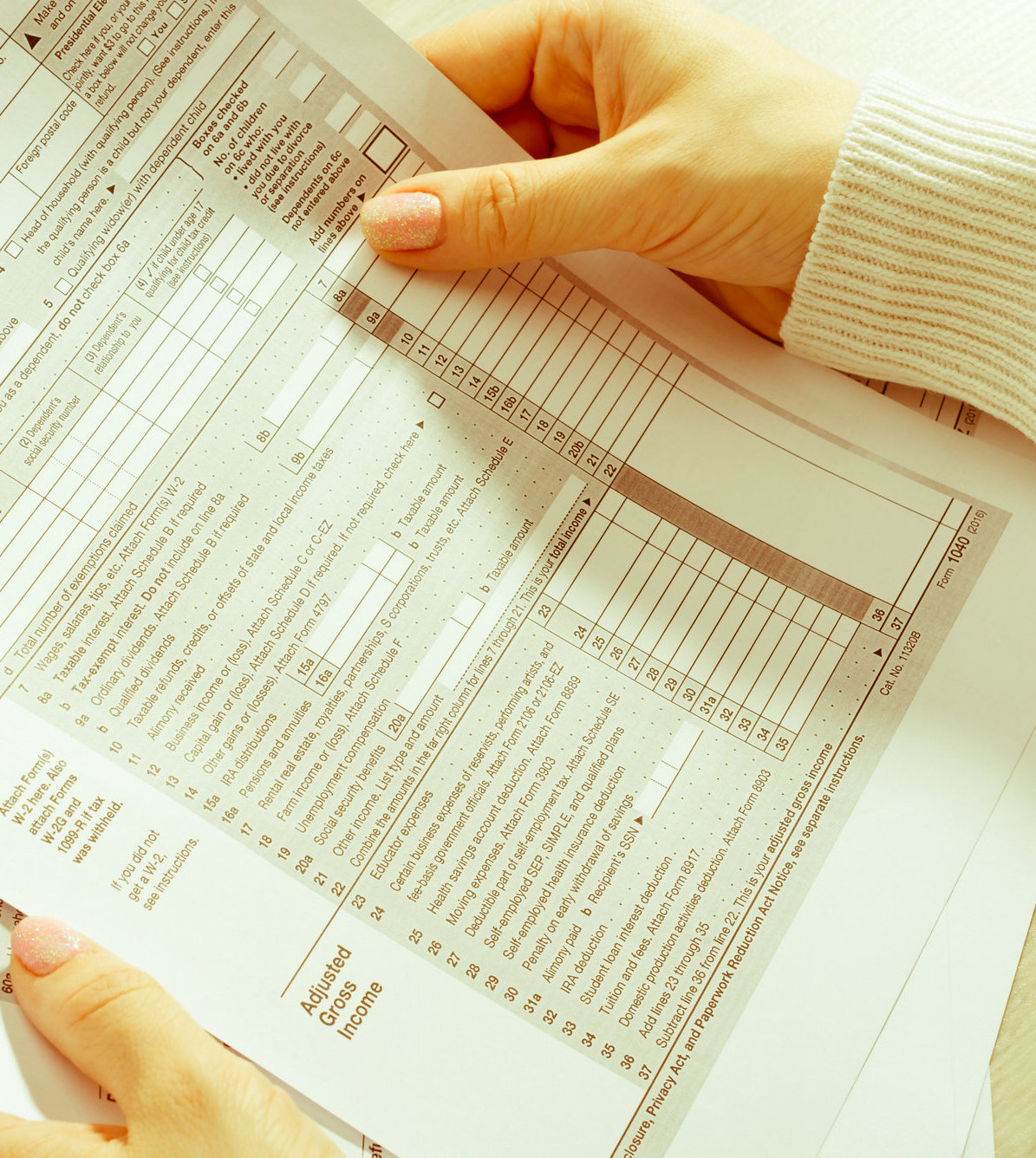

Returns I Prepare

1040

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return. IRS Form 1040 comes in a few variations.

1065

IRS Form 1065 is used to declare profits, losses, deductions, and credits of a business partnership for tax filing purposes. This form is filed by LLCs, foreign partnerships with income in the U.S., and nonprofit religious organizations.

1020S

Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

1120

Form 1120 is the tax form C corporations (and LLCs filing as corporations) use to file their income taxes. Once you’ve completed Form 1120, you should have an idea of how much your corporation needs to pay in taxes.

Course of Action

Onboard!

Let’s meet on the phone or video call! We will discuss the tax preparation process, including expectations and what information and documents we need to prepare your return.

Gather Information

This is where you are the star! You upload all needed information in our secure portal.

Prepare Return

I don’t start working on a return until all the needed information is in! Depending how complex your return is, preparation can take anywhere from about 2 weeks to a few more than that.